!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

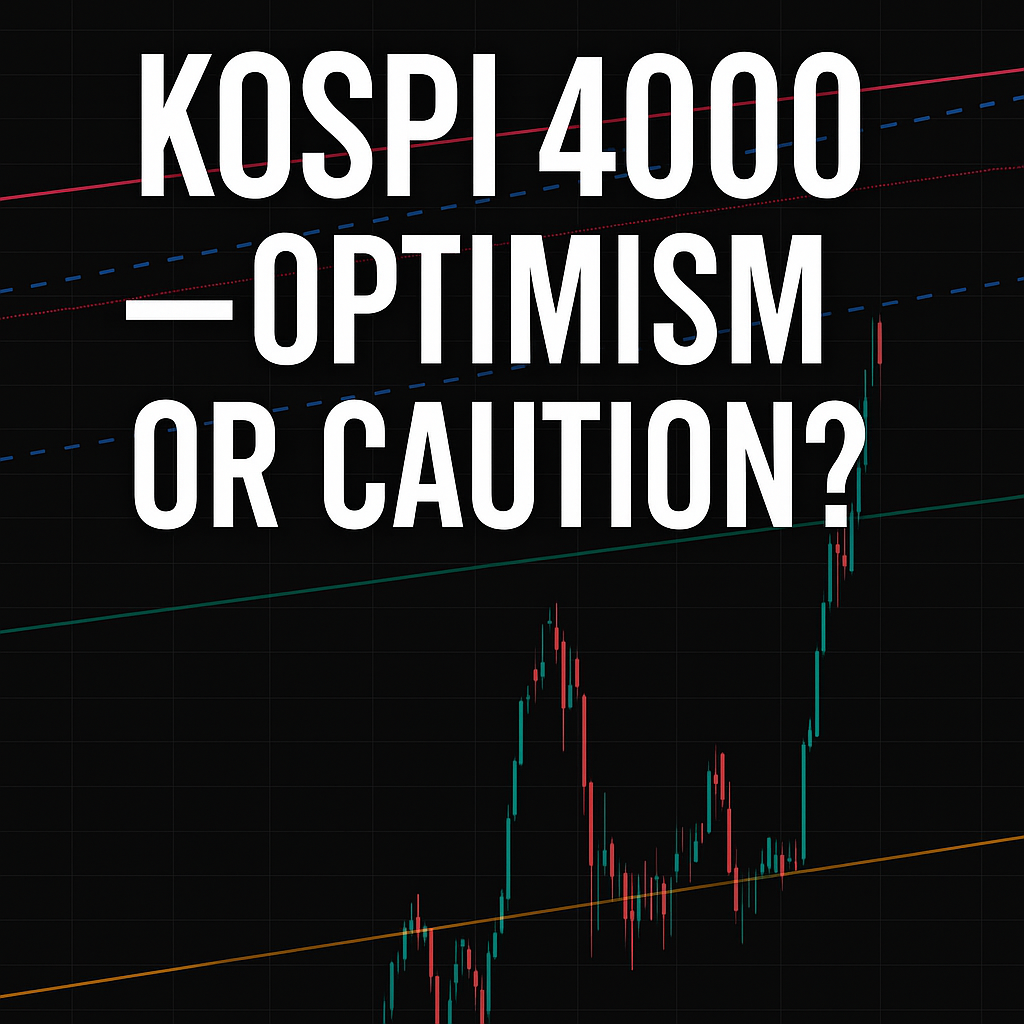

Market Overview — A Sharp Turn After Presidential Optimism

Following President Lee Jae-myung’s ambitious “KOSPI 5000 initiative,” the Korean stock market initially showed strong momentum,

soaring to 4200 points earlier this quarter. However, since November 1st, the index has fallen sharply, breaking below the symbolic 4000 level — a move largely attributed to foreign investors realizing profits after months of gains.

Currently, the key support zone lies near 3660, and investors are closely watching whether this level can hold.

This correction marks one of the most significant pullbacks since the mid-year rally, signaling a shift in investor sentiment from optimism to caution.

Long Perspective — Still a Structural Uptrend, but Fragile

From a longer-term viewpoint, Korea’s economic fundamentals remain relatively stable. Manufacturing output has improved slightly,

and semiconductor exports — a key pillar of the KOSPI — show signs of gradual recovery. If the 3660 support is defended and liquidity returns through institutional and pension fund inflows, the market could stabilize above 3800–3900 in the coming weeks.

For long-term investors, this may represent a healthy correction, provided that global risk sentiment doesn’t deteriorate further.

Yet, sustained foreign outflows could easily neutralize any domestic buying power.

Short Perspective — A Brewing Domestic Risk

The short-term picture, however, looks far more concerning. Two major red flags stand out:

1) Over-leveraged Retail Investors

Years of “FOMO investing” and “all-in leveraging” have led millions of retail investors to borrow heavily to participate in the rally.

If this downtrend extends, the risk of massive personal losses and credit defaults rises sharply — creating systemic stress in consumer finance and credit markets.

2) Institutional Buying Near the Limit

Domestic institutions and the National Pension Service (NPS) have been key drivers of this year’s rally. However, the NPS is already near its 14.9% equity allocation target. Should foreign investors continue selling, institutions will have limited capacity to absorb the downward pressure, potentially accelerating volatility. In the immediate term, 3660 will act as the decisive line in the sand. Failure to defend it could open the next support near 3330, an additional 8–9% downside from current levels.

Between Correction and Collapse

While some analysts argue that KOSPI’s recent fall represents a “healthy correction,” the broader situation suggests heightened risk.

A prolonged decline could ripple through household debt, consumer confidence, and even domestic credit markets.

In short — the Korean stock market stands at a critical juncture. If 3660 holds, the market may recover gradually.

If it breaks, however, the narrative could shift from “adjustment” to “panic.”