Market Overview

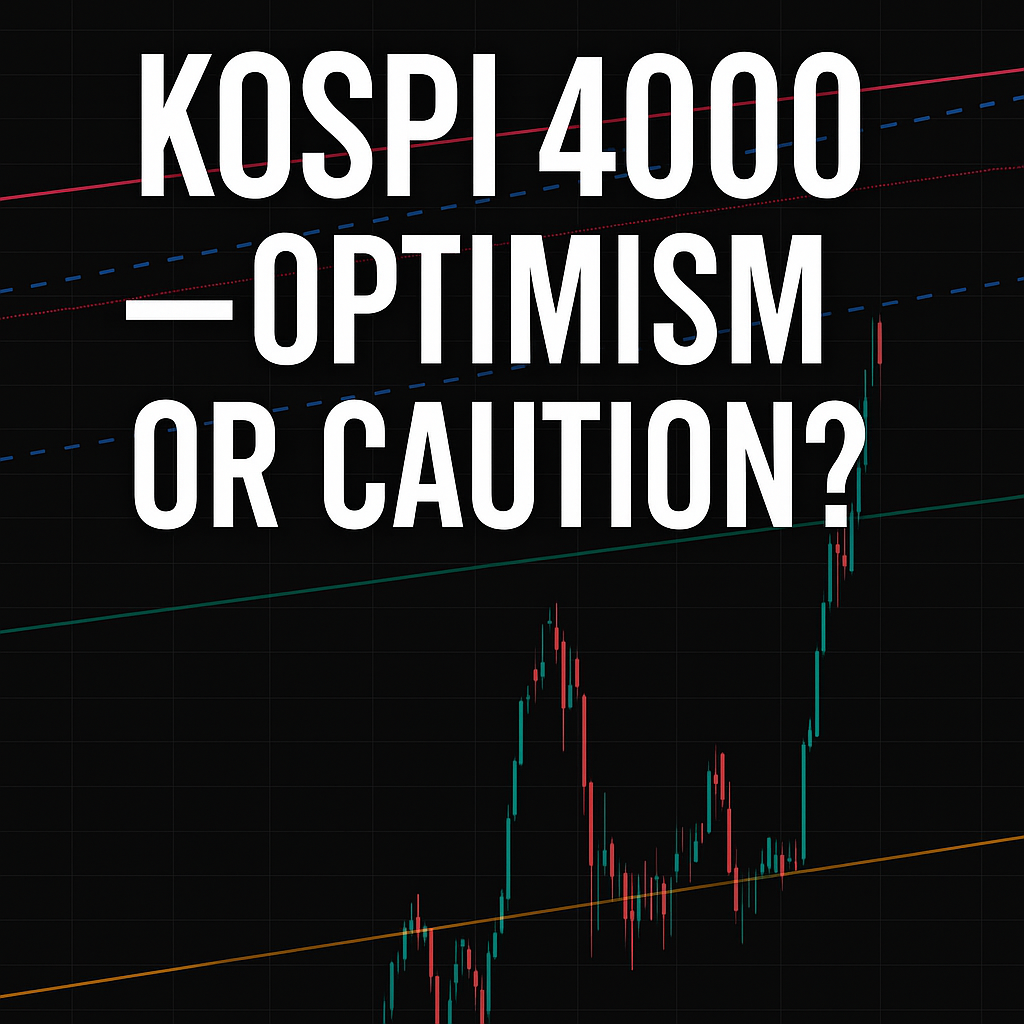

The KOSPI index briefly touched a daily high of 4,226 points before retreating to 4,121, signaling uncertainty in Korea’s equity market. Investors remain divided after a strong multi-week rally fueled by government stimulus expectations and global tech optimism. While short-term sentiment remains positive, volatility across key sectors suggests that caution may be warranted.

The Bullish View — “Momentum from Policy and AI”

Optimists argue that the recent rally is a natural continuation of both AI-driven U.S. market strength and Korean policy stimulus under President Lee Jae-myung’s economic revival agenda.

Supporters believe the government’s expansionary fiscal policies and interest rate stabilization will strengthen domestic demand and push the KOSPI toward the 5,000 mark.

Sectors tied to semiconductors, AI infrastructure, and energy transition continue to attract institutional and retail inflows, indicating that confidence in Korea’s long-term growth story has not yet faded.

The Bearish View — “Artificial Growth and Foreign Outflows”

Skeptics, however, warn that the recent surge may be unsustainable.

They point to a concentration of gains in a handful of large-cap stocks and heavy intervention from public funds, such as the National Pension Service, which has nearly reached its annual equity allocation cap.

Foreign investors have also started pulling funds since November 3, reducing market liquidity and highlighting potential vulnerabilities.

Many analysts worry that if institutional buying slows, the index could retest the 3,660 support level, erasing much of its recent gains.

Conclusion — Defensive Strategy May Prevail

While both optimism and caution dominate market discussions, the KOSPI’s near-term trajectory remains uncertain.

Historically, retail investors enter late in rallies and face steep corrections afterward — a pattern already visible in recent sessions.

At this stage, the market may reward discipline and defensive positioning more than aggressive speculation.

With global macro conditions still unstable, preserving capital might be the wisest strategy for the remainder of the quarter.