Warning: This article does not constitute investment advice. Any losses incurred are your responsibility.

A Rally from the Depths of Fear

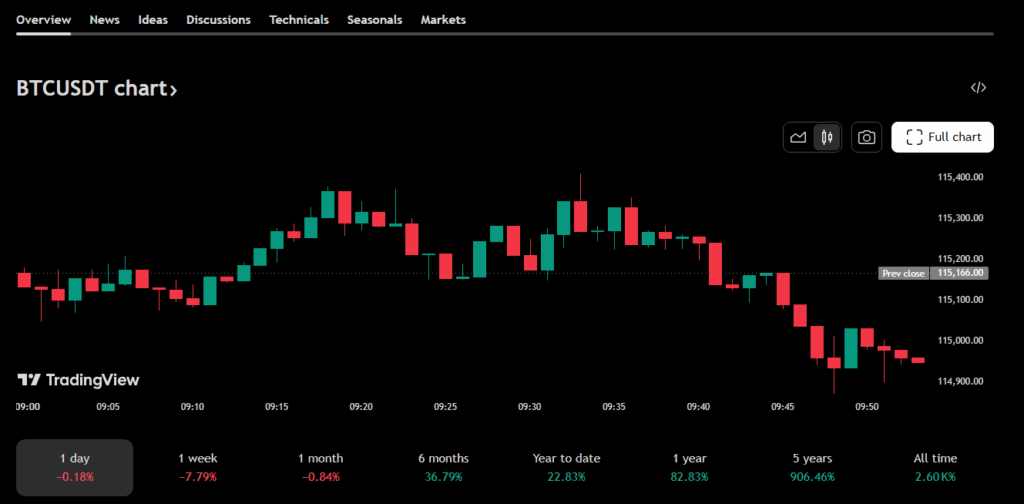

As of October 14, 2025, the crypto market finds itself riding a dramatic swing. Bitcoin is still under the shadow of a Fear & Greed Index reading around 38 (Fear), yet price action has defied what many would expect under such sentiment. In recent sessions, the entire market — from Bitcoin down to mid-caps and major altcoins — has rallied sharply after a brutal correction triggered by geopolitical tensions.

The latest catalyst? A sudden escalation in rare earths trade conflict between the U.S. and China unleashed a wave of fear, triggering mass liquidations. However, U.S. President Donald Trump jumped into the fray via Twitter, promising that relations with China would “be good,” and that message alone seemed to flip sentiment broadly, igniting a rebound across crypto assets.

Interestingly, just a day before, market commentators were warning of retests of “broken channels” and the need to find a new floor. That scenario hasn’t been ruled out — but the swift recovery suggests we might be witnessing more than just a bounce. With over 90% of long positions reportedly liquidated, the derivatives market seems primed to shift gears and hunt shorts rather than longs. Yet despite Bitcoin’s own modest move lately, many altcoins have posted 3–5%+ gains, showing that the rebound is not isolated.

Over the last two days of gains, investors are still wrestling with uncertainty. Even if Bitcoin breaks above the next resistance at ~$118,000, many will remain wary: gains alone may not quell lingering doubts. And that wariness is not unfounded — prudent investors do not simply throw caution to the wind.

So where do you stand now? Are you leaning toward continuation of a bull surge, or preparing for a pullback?

Long or Short?

A. Long (Bullish) View — The Reversal Could Be Real

- Leverage Cleansing & Short Squeeze Potential

With a massive purge of long bets behind us, one of the strongest tailwinds now favors the bulls. With so many longs already wiped, the path of least resistance may be forcing short covering to drive further upside. - Macro & Sentiment Tailwinds

Trump’s tweets have already shown they carry weight in risk markets. In this instance, his calming words about China appear to have triggered relief flows across equities and crypto. The resulting shift in sentiment can act as a spark, especially now that fear appears overstretched. - Altcoin Strength Bolsters Depth

It’s notable that many major altcoins have outpaced Bitcoin’s own rally, posting +3–5% or more gains. That breadth suggests capital is not just parachuting into Bitcoin, but rotating across the board. A broad rally tends to sustain momentum. - Technical Upside If Key Resistances Break

If Bitcoin can decisively push past $118,000, it would invalidate many near-term bearish arguments. Higher targets — possibly $125,000+ — become realistic if momentum holds. Indeed, some analysts are eyeing corrections toward these levels. FOREX24.PRO+2Brave New Coin+2 - Institutional & On-chain Signals

Reports of corporate / strategy funds buying more Bitcoin amid the rebound and increasing outflows from exchanges strengthen the narrative that “smart money” may see the bottom in. 비트코인 매거진+2Brave New Coin+2

B. Short (Bearish) View — The Rebound Could Falter

- Broken Technical Structure & Risk of Reversal

The liquidation event punched through multiple key trendlines and support zones. Regaining them is far from guaranteed. This leaves the market vulnerable to tests of the lower bounds. - Sentiment Is Still Fragile

Despite the rally, the Fear & Greed Index remains in Fear territory, and retail confidence is likely still muted. If buyers pull back, there’s limited cushion left. - Re-test of Support Zones Likely

Even if we rally, a meaningful retest of broken supports near $113,000–$110,000 (or lower) remains on the table. Failure to hold those zones could reignite a downward spiral. - Macro / Geopolitical Risk Still Looms

The rare earth trade spat between the U.S. and China is far from resolved. Any harsh retaliation or renewed tariff escalation could spook the markets anew. - Overextension & Exhaustion Risk

A two-day rally after a crash can be deceiving. Without sustained volume or new catalysts, this could be a relief bounce in a broader consolidation or downward phase.

Surge or Setback?

Bitcoin is currently hovering in a rebound zone, while many altcoins are climbing aggressively — a sign that broader market participation is in play. But does that confirm strength or mask weakness?

- If Bitcoin can break and sustain above ~$118,000, we may see extension toward $125,000+ in the near term.

- Conversely, a failure to hold above $113,000–$110,000 could force another leg down, possibly retesting lower supports.

The derivatives market is especially interesting now: with most longs liquidated, the momentum may lean toward trapping shorts. But that’s only if sentiment, volume, and macro conditions align.

For now, caution is warranted. The path of least resistance may favor bulls if momentum builds, but the market could just as easily swing back under pressure. Your conviction should come from your risk tolerance and your edge (technical plus macro plus on‐chain signals).

Where do you lean now: the bull side or the bear side?

Join the Discussion Share your take with the community →