!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

A Measured Comeback Above the Half-Line

Bitcoin is once again showing strength, currently trading around $114K (BINANCE:BTCUSDT) after a 3% rise in the past 24 hours.

The market’s optimism stems from recent reports suggesting that the U.S.–China trade discussions are progressing more constructively, easing one of the biggest macro uncertainties that weighed on global risk sentiment last week.

Most major cryptocurrencies are following Bitcoin’s lead, showing mild to moderate gains. However, despite the encouraging rebound, this movement is best viewed as a cautious attempt to regain momentum, not yet a full-fledged uptrend.

Technical Perspective — A Battle Between Recovery and Resistance

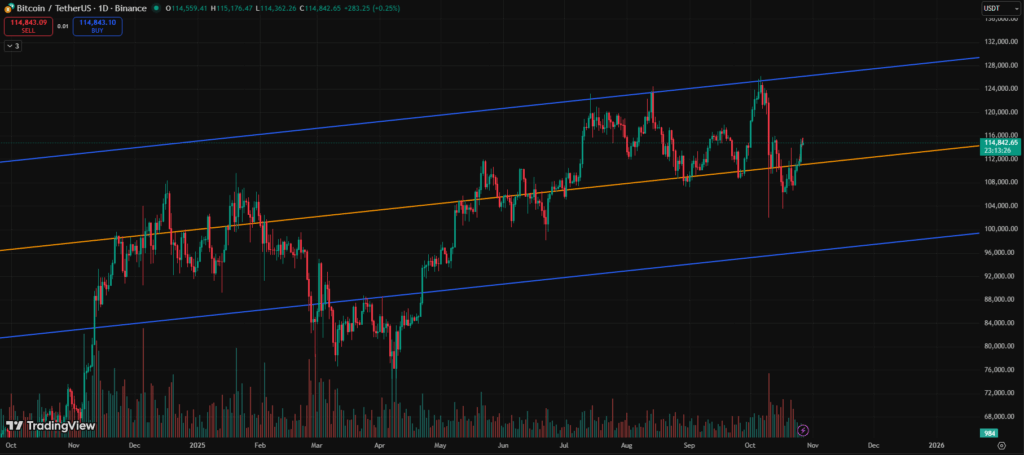

Bitcoin’s recent behavior indicates that the half-line (around 111K) has successfully held as short-term support. The asset now faces a crucial test:

- Immediate Resistance: $114K–$115K, the same zone that capped rallies earlier this month.

- Key Support: $111K–$110K, the confirmed retest zone that defines current trend structure.

- Momentum Target: If 114K is cleanly broken, the next visible resistance lies near 116K–118K, marking the top of the current mid-range channel.

Technically, the structure looks constructive — a “break and retest” setup — but confirmation will depend on whether Bitcoin can sustain a daily close above 114K with healthy volume.

Traders note that the next few candles will decide whether this is a recovery leg or just another bull trap before consolidation resumes.

Sentiment Shift — From Fear to Stability

Just a week ago, market sentiment was dominated by fear. The Extreme Fear Index and leveraged liquidations drove many traders to reduce exposure.

Now, with the half-line successfully defended and macro fears easing, the environment feels calmer.

However, this calm doesn’t necessarily mean it’s time to get aggressive.

- High-leverage positions are no longer favorable; most of the short-term volatility play is over.

- The current phase favors steady, low-risk accumulation or swing entries, focusing on confirmation over speculation.

- For cautious traders, the half-line remains the clear stop-loss reference — a decisive break below would invalidate the current structure.

In other words, the panic-driven phase may be over, but discipline remains essential.

Macro Factors — Hope Meets Caution

Positive catalysts:

- Ongoing U.S.–China trade improvements are restoring global confidence.

- The Fed’s tone toward rate cuts continues to support risk assets.

- Expectations that the government shutdown will be resolved remain elevated

Lingering risks:

- Macro liquidity remains fragile, and new data releases could still shift central bank policy.

- Institutional flows remain uneven; ETF inflows from BlackRock and Fidelity are slowing after a strong start to the month.

Overall, the environment supports stabilization — not yet acceleration.

Controlled Optimism Ahead

Bitcoin’s recent strength offers cautious optimism: the half-line retest has held, and the market is regaining balance.

If bulls can push through $114K and hold it into the weekend, it would mark a decisive shift from defense to offense, opening the path toward a challenge of previous highs near 116K–118K.

However, if momentum fades and the price drifts back below 111K, it could signal a short-term exhaustion, reminding traders that recovery phases often come with false starts.

For now, it’s a moment of balance — a market testing conviction as much as resistance.