!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

Testing the Half-Line Again

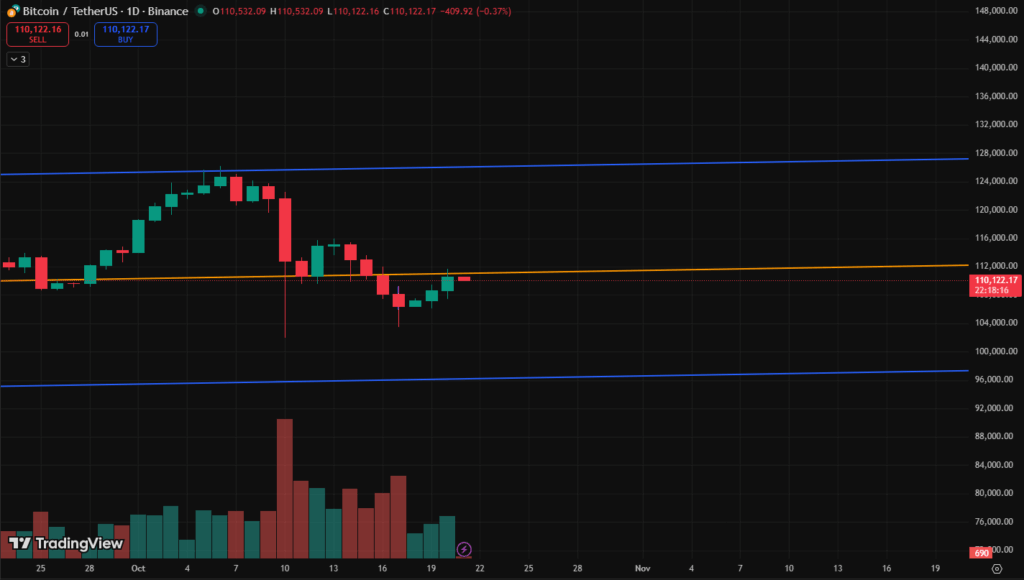

Bitcoin is once again attempting to stabilize around the 112K level, the midpoint of its current trading channel. After yesterday’s failed breakout above this resistance zone, the market appears to be gathering strength for another push. The move marks a critical juncture — one that could determine whether Bitcoin enters a fresh accumulation phase or slips back into its prior consolidation range.

Currently, macro forces are pulling in opposite directions. On the bearish side, the U.S.–China trade tariff dispute continues to fuel uncertainty, while on the bullish side, optimism stems from expectations of a U.S. government shutdown resolution and potential interest-rate cuts hinted at by the Federal Reserve. Yet, traders are fully aware that the downside from tariffs could outweigh the upside from policy relief, leaving sentiment cautious and volatile.

Macro Crosscurrents — Conflicting Forces at Play

- The Trade-War Overhang

The tariff tensions between the U.S. and China have once again become a headline risk. President Donald Trump’s stance remains the wild card: a decision to impose broader or higher tariffs could send risk assets — including crypto — sharply lower in the short term. Markets are pricing in the possibility of additional pressure if negotiations stall or rhetoric escalates. - Shutdown Relief & Policy Easing

On the flip side, there are positive catalysts. The expected end to the U.S. government shutdown could restore confidence, while rate-cut speculation supports the broader risk-on narrative. However, the scope of these “good news” factors is likely limited compared to the potential shock from trade disruptions. - Investor Sentiment — Neutral to Defensive

The Fear & Greed Index has stabilized near the low-30s range, showing hesitation but not panic. Traders are largely waiting for confirmation — either a decisive breakout above 112K or a pullback to retest lower supports near 110K. Volume profiles suggest that market participants are accumulating quietly, but conviction remains weak until macro clouds clear.

Technical Picture — The Battle Around 112K

- Support Zone: $110K–111K — this remains the area of structural demand. If Bitcoin stays above it for multiple sessions, buyers could regain short-term control.

- Resistance Zone: $112K–114K — the half-line region. A clean daily close above 112K would signal that the consolidation phase might be ending.

- Breakout Target: Above 114K opens the path toward 116K and 118K, both critical to re-ignite momentum.

- Failure Case: A rejection with a close below 110K would likely trigger renewed liquidation pressure and a revisit of sub-107K levels.

At present, BTC is trading in a low-volatility coil, with order-book data showing both bulls and bears reloading. The next decisive move will likely emerge within 24–48 hours of a confirmed half-line close.

Outlook — The Calm Before the Next Wave

Today’s market is expected to be slow, range-bound, and tactical. Traders appear content to watch Bitcoin “gather power,” as one analyst described, waiting for liquidity to build before attempting another directional push.

If the price anchors above 112K, the following day could mark the beginning of a new upward leg — potentially accompanied by rising altcoin participation and short-covering. If not, another leg of consolidation within 110K–112K may continue through the week.

For now, patience dominates. The next breakout or breakdown will reveal whether Bitcoin’s current pause is accumulation before liftoff or exhaustion before retreat.