!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

A Sudden Shift in Momentum

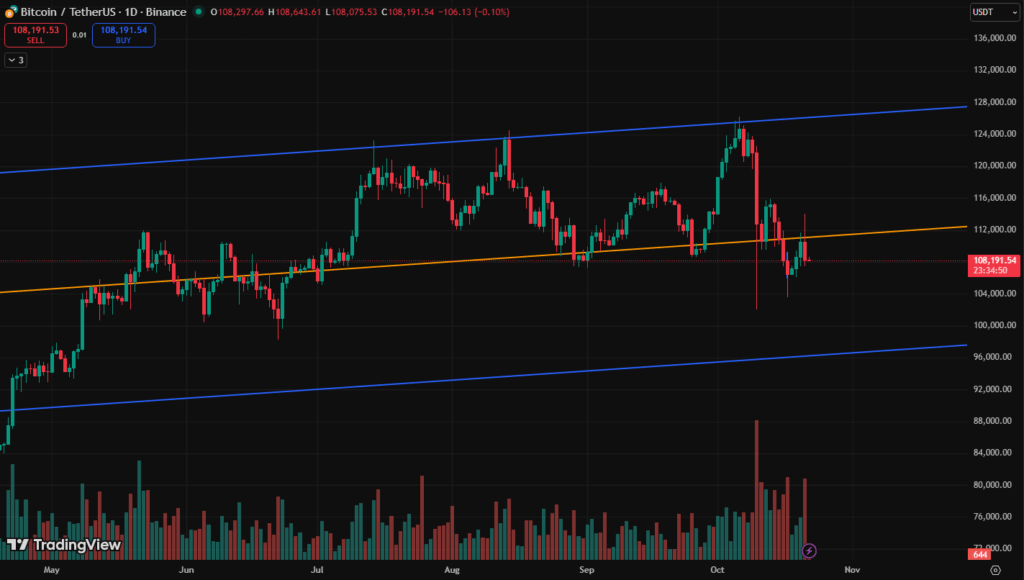

Bitcoin’s momentum has flipped sharply in the past 24 hours. After surging to $114K with strong accompanying volume, the market failed to hold the breakout and is now trading near $108K, having cleanly broken through its critical half-line support. This move marks a significant change in sentiment, as the market that once looked ready to reclaim higher ground now appears to be entering a phase of renewed downside pressure.

The sequence of events — a high-volume breakout, failed retest, and clean support loss — aligns perfectly with a technical breakdown pattern. Following the rejection at $110K (the retest zone), Bitcoin has completed a textbook bearish setup that, from a charting perspective, leaves the door open for a deeper correction — potentially as low as $96K.

Still, this market has never moved in straight lines, and history shows that when short interest spikes, Bitcoin often surprises with sharp short-covering rebounds.

Technical Overview — A Classic Breakdown Structure

- Failed Support at the Half-Line (112K)

The half-line served as both a structural pivot and sentiment barometer. Once it gave way, bearish momentum accelerated quickly, pulling BTC down to the next support region at 108K. - Textbook Retest of Resistance (110K)

Shortly after breaking below the half-line, Bitcoin retested 110K from below — a key confirmation of trend reversal. This retest reinforced bearish conviction and triggered additional short entries, confirming a lower high pattern. - Target Range and Next Supports

Based purely on technical projection, the next significant area lies between 98K–96K, representing both prior liquidity clusters and a 0.618 Fibonacci retracement from the last major swing. - Volume and Open Interest Trends

Derivatives data show a rise in short positioning and a drop in long open interest — evidence of cautious sentiment. However, funding rates remain moderate, suggesting this move is more spot-driven than purely speculative.

Macro Context — Conflicting Winds Still Blow

- Positive Factors:

The potential U.S. government shutdown resolution and expectations for a rate cut remain supportive undercurrents. If realized, these could soften downside momentum and provide macro relief. - Negative Factors:

The U.S.–China trade conflict continues to hang over global risk sentiment. A renewed escalation driven by tariff measures or harsh rhetoric could exacerbate volatility, particularly in crypto markets that are already jittery.

In essence, Bitcoin now sits in a macro tug-of-war, where policy optimism is battling geopolitical risk. For traders, that means volatility — not direction — may dominate in the near term.

Psychological Landscape — Between Fear and Conviction

Market psychology is once again under stress. The clean break below 112K and the swift move to 108K have eroded confidence, with many traders turning defensive. Yet, the extreme bearish positioning could set the stage for sharp counter-moves. Historically, Bitcoin has shown a tendency to rally when sentiment becomes overly one-sided — especially when the majority anticipates further decline.

In such phases, discipline and risk management are critical. Over-leveraging shorts near support or averaging down prematurely can both lead to liquidation traps. The wisest approach now may be to stay nimble and respond to confirmation rather than prediction.

Watching for Reversal Clues

The next few sessions will likely determine whether Bitcoin’s recent breakdown turns into a sustained downtrend or a bear trap. Key zones to watch:

Immediate resistance: $110K — reclaiming this would neutralize the short-term bearish bias.

Major support: $106K–$107K — holding here could trigger relief bounces.

Downside risk: Extended correction toward $98K–$96K if selling persists.

For now, the trend favors caution. But if Bitcoin proves once again that it “doesn’t follow the chart,” a sudden rebound could catch shorts off guard. This is the kind of moment where patience, not prediction, pays.