!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

The Half-Line Fails Under Pressure

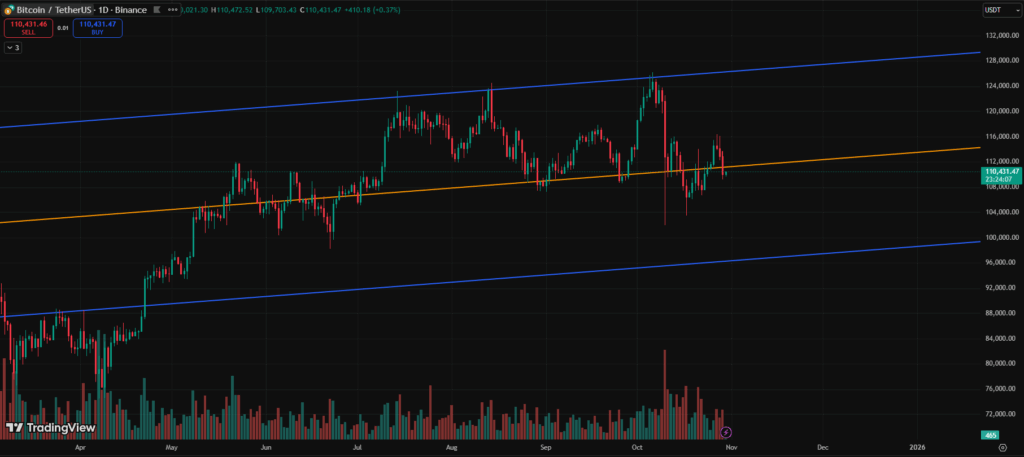

Bitcoin has once again fallen below the critical half-line support, a psychological and technical level that traders have been watching closely for weeks. Despite seemingly positive macro headlines — including rate cut expectations and the end of quantitative tightening (QT easing) — the market’s reaction has been far from optimistic.

As of today, Bitcoin trades near $110K (BINANCE:BTCUSDT 기준) after a sharp selloff that accelerated once the half-line around 111K gave way. The decline reflects how macroeconomic uncertainty has overshadowed short-term optimism, especially following ambiguous comments from Federal Reserve Chair Jerome Powell, who hinted that the path of future rate cuts remains uncertain.

Technical Overview — Breakdown Confirmed, Next Levels in Sight

From a chart perspective, Bitcoin’s rejection at 116K earlier this week signaled weakening bullish momentum. Since then, the market has printed a series of consecutive red candles, culminating in a decisive break below the half-line.

Key technical zones now include:

- Immediate Resistance: $111K–$112K (former half-line support, now resistance).

- Current Price: ~$110K — a fragile zone that could determine short-term direction.

- Next Major Support: $107K–$108K — where historical demand previously emerged.

While higher lows in the recent short-term trend can be viewed as mildly positive, the overall structure now leans bearish until Bitcoin reclaims the half-line with conviction.

Market Sentiment — Between Hope and Hesitation

The market’s mood is split. Optimists highlight the potential for renewed bullish momentum if the half-line retest leads to a quick rebound, citing past instances where Bitcoin sharply recovered after similar breakdowns. Pessimists, however, warn that technical weakness combined with macro hesitation could prolong the decline toward the next lower channel.

- For spot investors: Gradual accumulation at current levels might still make sense, but risk control is key.

- For futures traders: Today’s zone demands patience — wait for confirmation of direction before re-entering. Entering aggressively now could expose traders to both false breakouts and liquidation traps.

The market remains in emotional limbo, neither fully fearful nor confident — a classic setup for volatility.

Macro Environment — Good News Meets Doubt

Even with rate cut hopes and liquidity easing from QT relaxation, the market remains cautious. The Federal Reserve’s mixed tone, paired with Powell’s comments about “monitoring the risks of premature easing,” left investors uncertain.

Meanwhile, the U.S.–China trade narrative and APEC meeting developments have introduced short-term optimism but not enough conviction to reverse technical damage.

Essentially, macro signals are supportive in theory but indecisive in practice, leaving traders unsure whether to treat this as a temporary dip or the beginning of a deeper correction.

The Half-Line Retest Will Define Direction

If Bitcoin stabilizes above $109K and reclaims $111K quickly, this could still qualify as a “false breakdown”, setting the stage for a sharp rebound toward $113K–$114K.

However, if sellers continue to dominate and the price slips below $108K, the market may once again enter a renewed fear cycle, potentially targeting the lower channel near $104K–$106K.

For now, discipline is key. This is not the time to predict — but to prepare. The next few sessions will likely define whether the half-line breakdown marks a shakeout before a reversal, or the start of another corrective leg in Bitcoin’s ongoing journey.