!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

The 116K Rejection and the Market’s Next Test

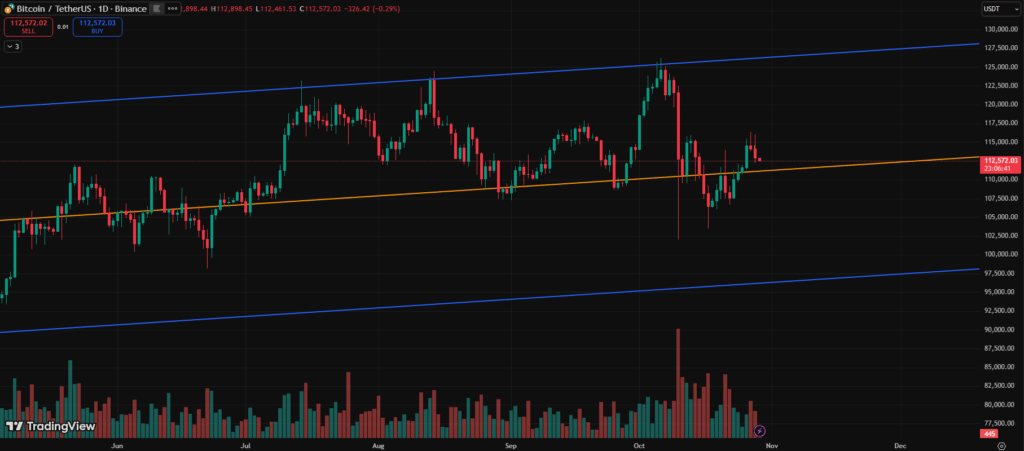

Bitcoin has once again tested the critical 116K resistance zone but failed to break through, marking the second consecutive day of rejection. The move underscores just how strong the sell pressure remains at that level. After a brief rally earlier in the week, Bitcoin has now fallen back toward the 112K region, losing short-term momentum as traders reassess market direction.

This rejection also reaffirms what the charts have been signaling — 116K is not just a number, but a major wall of liquidity and resistance, historically tied to previous distribution zones.

Technical Overview — Support Retest Below the Half-Line

At present, Bitcoin hovers near $112K (BINANCE:BTCUSDT), setting its sights once again on the half-line support around 111K.

- Resistance Zone: $115.8K–$116.2K — the area of repeated rejection, confirming strong sell orders.

- Support Zone: $111K–$112K — the half-line, previously confirmed as a springboard for recovery.

- Neutral Zone: $113K–$114K — intraday battle area where traders are waiting for confirmation.

If Bitcoin holds the half-line, the structure of higher lows remains intact, keeping the bullish case alive. However, a clean break below 111K could reopen the door to deeper correction, possibly toward 108K–106K.

At this point, trading aggression is risky for both long and short positions. Patience around the support zone may provide safer, data-driven entries.

Market Context — Fundamentals Still Favor Optimism

Despite the short-term technical weakness, macro catalysts remain constructive:

- APEC summit discussions have hinted at a potential easing in U.S.–China trade tensions, a relief for global risk sentiment.

- The Federal Reserve’s upcoming rate announcement is expected to confirm a dovish tone, reinforcing investor optimism.

- Broader markets, including equities and tech, are stabilizing — a sign that risk appetite may return soon.

However, markets are forward-looking, and many of these “positive” events may already be priced in. Traders know that Bitcoin often reacts counterintuitively — rising during fear and dipping when optimism peaks.

Sentiment — Between Hesitation and Anticipation

The current zone reflects psychological indecision.

- Bulls are watching for confirmation that 111K will hold once again, hoping for a rebound.

- Bears, on the other hand, are seeing each rejection at 116K as proof that the rally is losing energy.

- Most traders are sitting on the sidelines, reducing leverage and waiting for a decisive daily close to define the next wave.

This phase — the calm before a breakout or breakdown — is typically when liquidity traps form. As such, clear confirmation is vital before entering any position.

Retest First, Reaction Later

The next 48 hours will be crucial. If Bitcoin successfully defends the half-line and forms a bullish reversal candle above 112K, a rebound toward 114K–115K remains possible. But if selling persists and 111K fails to hold, the next stop could be 108K, a zone that marks the previous consolidation base.

For now, traders should prioritize defense over prediction — this is a moment to protect capital, not chase volatility.

Bitcoin has proven time and again that its strongest rallies begin in moments of doubt, but those same moments can also deliver sharp corrections.

The half-line will once again decide whether this is a retest before a rally — or the start of a deeper pullback.