⚠️ This article is not intended for investment purposes.

The global cryptocurrency market was thrown into turmoil this week after one of the largest futures liquidation events in recent memory. Bitcoin’s sudden plunge from around $121,000 USD to the $101,000 range wiped out more than $3 billion in leveraged positions across major exchanges. Within hours, both long and short traders faced unprecedented losses, and social media erupted with allegations of market manipulation.

1. Record Liquidations and Price Shock

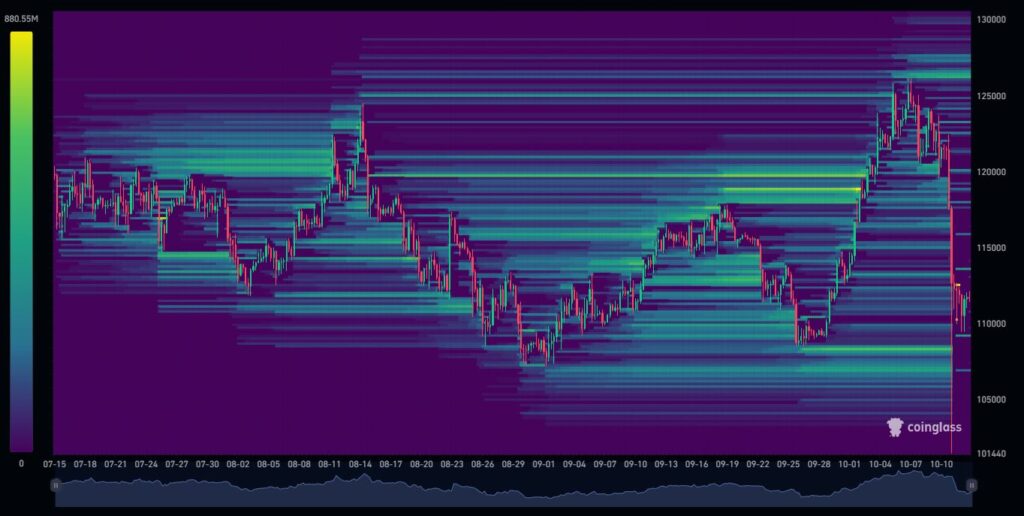

Data from CoinGlass shows over 270,000 traders liquidated within 24 hours, with total forced liquidations exceeding $3.2 billion USD. Bitcoin’s sharp 12% drop within minutes created what traders described as a “perfect storm,” echoing the market chaos last seen during the FTX collapse in 2022.

2. Allegations of Manipulation Spread Online

Within hours, speculation flooded Twitter (X), Reddit, and Telegram. Many users alleged that large market makers and whales coordinated an artificial sell cascade to trigger over-leveraged liquidations.

Several analysts pointed to on-chain data showing synchronized sell walls and deep order book sweeps seconds before the crash.

“The pattern looked engineered,” wrote one veteran trader on X. “Massive spoof orders hit the books, triggering forced sells, and within minutes those same wallets started buying the dip.”

While unverified, these claims have renewed debate over exchange transparency and leverage oversight, as investors question whether retail traders can compete fairly in a market dominated by high-frequency algorithms.

3. Emotional Toll and Reports of Tragedy

(Unconfirmed Reports)

Beyond financial losses, the human cost of the crash has drawn concern. Several crypto community posts and Telegram groups reported that some investors allegedly took their own lives after heavy losses.

Although unconfirmed, such reports have circulated widely under hashtags like #BTCcrash and #CryptoCollapse, with traders urging platforms to strengthen risk-management systems and promote mental-health awareness among users.

Leverage of up to 125x offered on many exchanges continues to attract traders chasing outsized gains—but when volatility spikes, it amplifies devastation just as quickly.

4. Exchange Reactions and Market Anomalies

Binance released a short statement clarifying that “no internal system malfunction occurred and all trades were executed normally.” However, the absence of a technical explanation left investors uneasy, and anger spread across online communities.

Despite the widespread panic, BNB (Binance Coin) — Binance’s native token — rose by nearly 8% during the event, a move that puzzled analysts and fueled speculation about capital rotation toward exchange-based assets. Some observers argued that investors sought relative safety in platform-linked tokens amid broader volatility.

5. Market Sentiment and Long-Term Implications

Following the crash, futures open interest dropped by over 20%, signaling mass position closures. Many traders announced plans to withdraw from perpetual futures altogether, citing “emotional exhaustion” and distrust toward centralized exchanges.

Spot market volumes, meanwhile, briefly spiked as investors fled leveraged products for stablecoins or fiat holdings. Analysts warn that the incident could reshape the derivatives landscape, pushing for stricter margin limits and order-book transparency across exchanges.

“We’re seeing history repeat itself,” said Kim Dae-hun, senior analyst at the Seoul Digital Asset Center. “When greed meets opacity, collapses are inevitable. Unless leverage is curbed, these crises will continue in cycles.”

✍️ Editor’s Note

There have been many crises—from FTX to the COVID-era volatility—but this may be the worst short-term collapse in recent memory. Futures trading lives and dies by the long-versus-short decision, yet this time anger stems from the belief that the crash was a coordinated attack. Despite the turmoil, BNB continues to climb, seemingly unaffected. Many holders feel betrayed by the system and may now abandon both Binance and futures markets altogether.