!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

A Failed Recovery After the Breakdown

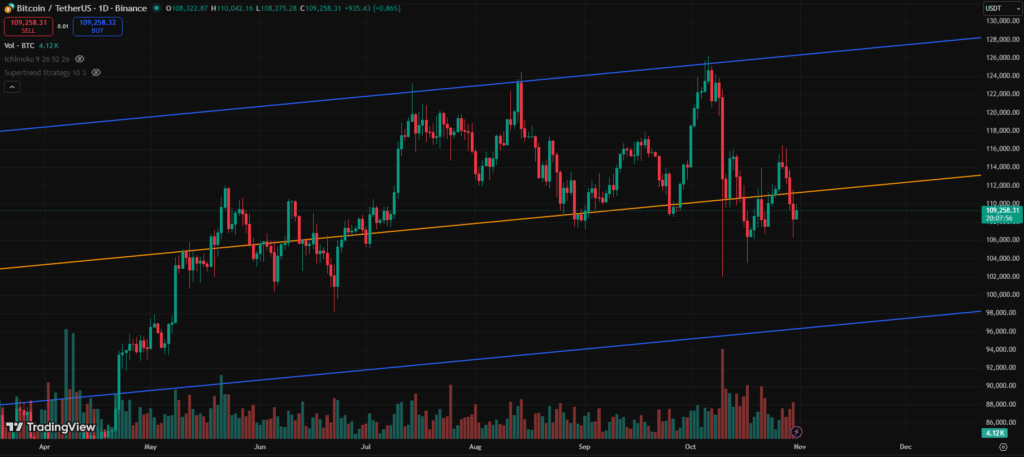

Bitcoin’s recent price action paints a picture of uncertainty and hesitation. After breaking below the half-line (around 111K) on October 29, the cryptocurrency attempted a recovery on the following day — only to fail the retest and fall sharply to $106K (BINANCE:BTCUSDT 기준) before staging a mild rebound.

The inability to reclaim the half-line confirms that the previous support has now turned into resistance, a classic bearish signal in technical analysis. While short-term traders interpret this as a sell or short opportunity, long-term investors might view it as the early phase of a potential accumulation zone.

Technical Overview — Resistance Strengthens, Eyes on 98K

From a structural perspective, Bitcoin’s recent movements have defined clear zones of control:

- Resistance Zone: $111K–$112K — the former half-line now acting as strong overhead pressure.

- Current Price: ~$110K — a neutral range with weak momentum.

- Support Zone: $106K (recent low), followed by $98K, the major futures support level and a key area that many analysts identify as a strong defensive base.

If Bitcoin continues to close below 111K, the probability of a lower channel retest near 98K increases significantly.

However, if it can form a higher low above 106K and stabilize, a gradual reversal toward the midrange (113K–114K) could still unfold.

At this stage, the market is technically fragile, and any direction taken will likely be amplified by trader sentiment rather than fundamentals.

Market Sentiment — Between Fear and Opportunity

Fear is once again creeping into the market. The Fear & Greed Index has dropped toward the “Fear” zone, reflecting rising anxiety among short-term investors. Many traders are liquidating positions or scaling back leverage, anticipating a deeper correction.

Yet, experienced investors often remind that true opportunity hides in discomfort.

- For long-term spot holders: This could be a time for gradual, disciplined accumulation — buying small portions across dips rather than timing the absolute bottom.

- For futures traders: A wait-and-see strategy remains optimal until confirmation of direction. Entering early carries risk of being trapped in a false rebound.

Macro Landscape — Hope Meets Conflict

The broader macro narrative remains mixed, creating confusion among market participants:

- Bullish Factors:

- The U.S. government shutdown resolution continues to relieve macro stress.

- Despite short-term volatility, institutional demand through spot Bitcoin ETFs persists.

- Bearish Factors:

- Federal Reserve officials’ conflicting statements about the pace and scope of future rate cuts have created uncertainty.

- Both Nasdaq and gold prices have experienced pullbacks, signaling caution across risk and safe-haven assets alike.

This divergence of signals has left the crypto market directionless — a battle between long-term optimism and short-term panic.

Between Capitulation and Accumulation

The coming days will test whether Bitcoin can hold above 106K or if a retest of the 98K support is inevitable.

A drop below 106K could trigger another wave of stop-loss liquidations.

A bounce from current levels with confirmation above 111K, however, might spark renewed optimism, especially if accompanied by improving macro tone.

In this volatile environment, strategy matters more than prediction. Whether one chooses to cut losses and wait for re-entry or buy the dip and scale in, the key lies in disciplined execution — not emotion.

As always, Bitcoin’s greatest rallies have emerged from the ashes of fear.

The question now is: Will this be another such moment, or the calm before a deeper storm?