!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

Introduction

Global financial markets have once again entered a consolidation phase. The Nasdaq Composite, after reaching its 26 K peak, has pulled back toward the low-25 K range, showing weakness across major technology and AI-related stocks. Profit-taking around large-cap tech names like NVIDIA has cooled risk appetite, adding to overall investor caution.

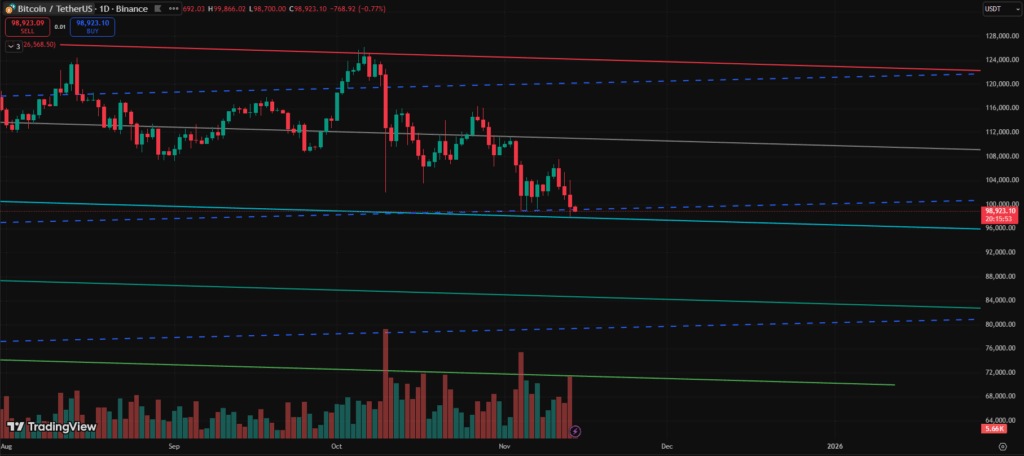

Within this macro backdrop, Bitcoin (BTC) has also experienced a correction. Yesterday, BTC briefly touched US $97,900 on some exchanges before stabilizing around US $98,800 today. This price zone represents a historically strong support channel bottom, often referred to by chart-based traders as a key “decision point.” Whether Bitcoin can defend this support level will likely define the near-term sentiment across both crypto and broader risk assets.

Main Body

1) Bullish Scenario — “The Perfect Rebound Zone”

Bitcoin’s current 98 K level has historically served as a strong rebound point and is considered an ideal technical entry zone by many traders.

– Technical View: The price sits near the lower edge of Bitcoin’s long-term ascending channel. If the 98 K zone holds, a retest of the upper

boundary near US $124 K becomes possible.

– Macro Factors: With the U.S. Federal Reserve signaling an end to its rate-hike cycle and the U.S. dollar index weakening, liquidity is slowly

returning to risk assets. This could provide upward momentum for Bitcoin as investors rotate back into crypto exposure.

– Market Sentiment: Derivatives data indicate that many traders have placed stop-loss orders just below 98 K, creating conditions for

potential short covering if the level holds. A sudden influx of buy orders could amplify a sharp rebound.

2) Bearish Scenario — “The Breakdown Threat”

If the 98 K support fails, a deeper correction could unfold.

– Technical View: A confirmed break below this channel bottom would open downside targets toward US $84 K, the next major support zone

defined by previous high-volume consolidation.

– Liquidity Risk: Recent long-position liquidations at higher levels have drained short-term momentum from the market. With institutional

“whales” off-loading positions, buying pressure could remain limited in the near term.

– Macro Headwinds: Persistent weakness in U.S. tech equities could further erode risk appetite. Given Bitcoin’s high correlation with the

Nasdaq, a sustained equity downtrend could constrain any independent crypto rebound.

Conclusion & Investment Outlook

Bitcoin currently stands at a critical technical crossroads near 98 K.

Holding this support could lead to a sharp rebound and renewed test of the 124 K resistance channel. Conversely, a breakdown below this level might trigger a broader mid-term correction toward the 84 K zone.

For short-term traders, confirmation of a clear rebound signal before entry remains essential, along with strict stop-loss management.

For long-term investors, the current zone could serve as a gradual accumulation area, provided macro conditions—particularly global equity trends and monetary policy—remain stable.

Ultimately, the key question this week is simple yet decisive: “Will Bitcoin hold or fold?”

The answer will shape not just the next leg of Bitcoin’s cycle but potentially the sentiment across the entire digital-asset market heading into year-end.

Sveiki, es gribēju zināt savu cenu.