!! Warning: This content is not investment advice. Losses are your responsibility. !!

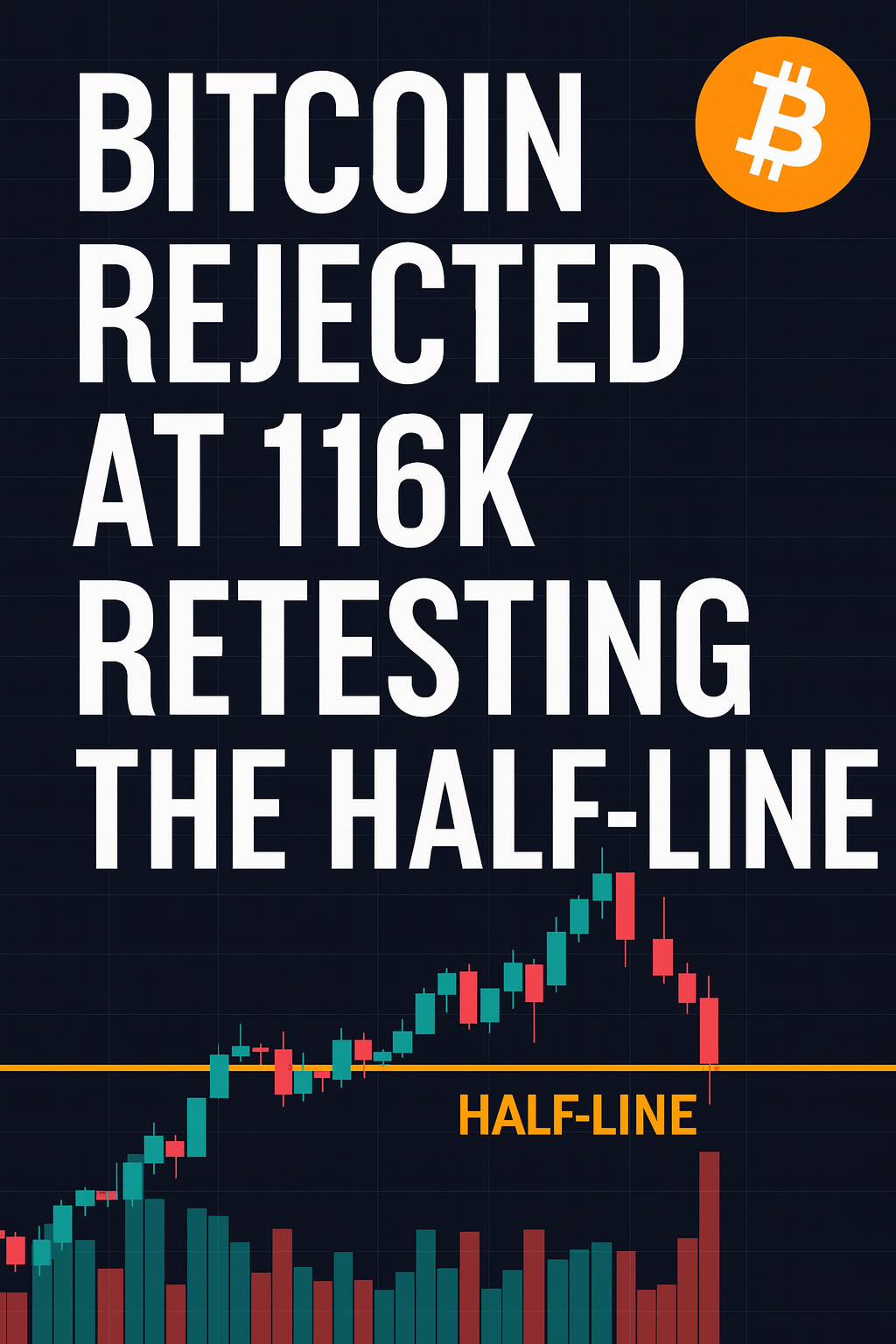

Testing the Half-Line

Bitcoin recently failed to break above resistance near 116,000 USD, forming 12 consecutive bearish 1-hour candles—a signal of sellers’ control in the short term. Yet, despite this pressure, Bitcoin found support around 111,000 USD, offering a glimmer of hope that the half-line (midpoint trend level) may be holding.

Amid renewed turbulence from the U.S.–China trade conflict and macro uncertainty, many would expect Bitcoin to buckle further. But some positives now emerging—Fed Chair Jerome Powell hinting at potential rate cuts, a possible end to certain shutdowns, and the near total liquidation of futures long positions—suggest the market may already be pricing in much of the external risk.

In a market where trust is fragile and many have withdrawn, Bitcoin still retains a seat at the table of global finance. Today, I lean toward a cautiously optimistic outlook: can Bitcoin rebound toward its previous highs?

Rise and Fall

A. Bullish View: Support Holds, Reversion Upward

- Half-Line Support as Foundation

The fact that Bitcoin did not slump below 111K, but instead held there, suggests that this zone may act as a base. If demand persists here, it could be the launchpad for a move back to resistance. - Capitulation & Clean Slate for Shorts

With long futures positions largely liquidated, the market’s leverage is minimized. Sellers now hold more exposure, so any upward move may trigger short squeezes. - Macro Tailwinds & Forward Guidance

Powell’s commentary hints that rate cuts could eventually come. If the central bank begins easing, risk assets like crypto may benefit. Also, policy shifts on government shutdowns could release pent-up capital flows. - Structural Recognition in Global Finance

Bitcoin is no longer fringe—it is recognized in institutional portfolios, ETFs, and global narratives. This built-in demand floor gives it resilience against pure sentiment collapses. - Technical Pathway to Previous Highs

If Bitcoin can retake 116K and then push through resistance at ~118-120K, targets toward previous peaks become plausible again. Momentum, volume, and confirmation above resistance levels will be key.

B. Bearish View: Weakness, Rejection, and Structural Risk

- Resistance Rejection at 116K

The inability to break 116K signals that sellers remain strong at that level. Until this barrier is convincingly cleared, upward moves remain tentative. - Extended Weakness & Trend Reversal Risk

Twelve straight bearish candles in the 1-hour timeframe hint at strong short-term downside momentum. If buyers can’t flip that, more downside is possible. - Downside Vulnerability if 111K Fails

If support at 111K breaks, Bitcoin may revisit lower levels—perhaps toward 108K or lower structural zones. That would invalidate the positive scenario. - External Shocks Could Reverse Sentiment

The trade war, rate surprises, or macro shocks could erode confidence, leading to a swift reversal. Many of those risks are already “priced in,” but surprises can still be destabilizing. - Low Conviction & Thin Volume

A move upward on weak volume or limited participation might be a trap. Without strong capital flow behind it, rallies can be short-lived and subject to reversal when momentum fades.

Ediotr’s Comment

Bitcoin currently sits at a crossroads. The half-line support around 111,000 USD is being tested. If it holds, there’s a clear path toward 116,000+ and higher resistance zones. But if it fails, the downside may be more serious than many expect.

Key levels to watch:

Support zone: ~111,000 USD

Resistance zone: ~116,000 USD, followed by 118,000–120,000 USD

Invalidation: daily close below 111K may shift bias bearish

While the short-term is messy, the longer term still leans in favor of upside if structural supports survive. In markets this volatile, it’s not foolish to believe in a rebound — but conviction must align with clear breakouts, volume, and macro confirmation.

Where do you tilt — bullish relaunch or another leg down?