!!! Warning: This article does not constitute investment advice. Any losses incurred are your responsibility. !!!

Fear Deepens, Yet 110K Holds

Bitcoin is trading near $110K, down roughly 3.8% day-over-day, while the Fear & Greed Index sits at 28 (Fear), signaling sentiment has deteriorated. Even so, the market’s ability to defend the 110K handle leaves a sliver of hope for traders who want to see a constructive base form before any meaningful rebound.

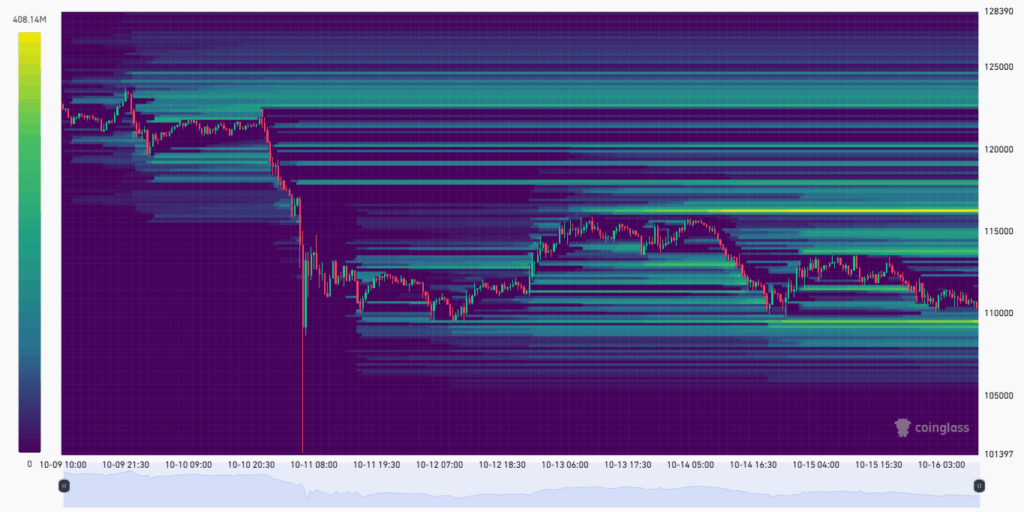

Derivatives data add color to the setup. Looking at liquidation heatmaps, there’s a visible pocket of long liquidity around ~$109.5K; if price wicks into that zone, a quick flush of remaining longs is plausible. Paradoxically, a targeted sweep into that liquidity—while painful—can reset positioning and sharpen the odds of a reflexive bounce if spot demand steps in immediately after.

Macro remains noisy (trade tensions, rate-path anxiety, risk-off spasms). But charts are edging toward an “extreme” phase: if BTC continues to hold above 110K and recover swiftly from any liquidity grabs below, the market could reclaim a constructive posture and attempt a re-test of overhead resistance.

What to Watch Next

Key levels

- Support: $110,000 (spot floor), then the liquidity pocket ~$109,500.

- Intra-day risk: A brief stop-run into $109.5K that quickly reclaims 110K would be a bullish deviation; a sustained break and close below increases downside risk toward deeper supports.

- Resistance: First local ceilings cluster near $116K, then $118–120K. Momentum needs volume to push cleanly through those.

Bullish path (what “good” looks like)

- Stop-run into $109.5K → swift reclaim back above $110K.

- Consolidation with higher lows on 1–4h.

- Open interest + spot bid rise without funding overheating.

- Break and hold above $116K to unlock $118–120K retests.

Bearish path (what to avoid)

- Multiple closes below $110K and failure to reclaim quickly.

- Rising OI with negative spot flow (derivatives-led bounces only).

- Weak breadth (alts roll over first), signaling risk appetite is fading.

In short: today’s story is about holding the floor. The market is fragile, but constructive behavior around 110K keeps the door open for a rebound attempt.

Binance Compensation — What It Is, Who Qualifies, How Payouts Work

You asked about Binance’s compensation for traders affected during liquidation periods—and you mentioned you received a partial credit. Here’s how Binance typically handles such events and how to estimate your effective compensation ratio:

1) What triggers compensation?

- Abnormal price behavior (e.g., index/mark price deviations, de-peg events on collateral),

- Platform or connectivity issues that materially impacted order execution or liquidation handling,

- Documented incidents within a defined window (Binance publishes an incident/announcement with scope, markets affected, and review process).

2) Who is eligible?

- Users whose positions were liquidated or materially worsened during the specified incident window.

- Some programs prioritize impacted instruments or collateral (e.g., specific perps, or assets that de-pegged).

- Claims are usually case-by-case; you don’t always need to file a ticket—Binance often pre-screens accounts—but opening a support ticket can speed manual review if you believe you qualify and weren’t credited.

3) How is compensation calculated? (typical approach)

While formulas vary by incident, the logic generally follows this sequence:

- Identify the reference price (e.g., index/mark or time-weighted fair value) during the incident window.

- Compare it to the execution/liquidation price your account actually received.

- Compute the delta attributable to the incident (not normal market risk).

- Apply caps or tiers (Binance often uses internal limits to prevent open-ended liability).

- Distribute credits in stablecoins or token vouchers to the user’s account.

4) Where and how do you see it?

- Wallet → Transaction History (look for Distribution, Voucher, or Compensation entries).

- Notifications / Inbox may include an incident summary with a line-item credit.

- Some cases arrive as Futures Bonus Vouchers; check Profile → Reward Center.

5) How to estimate your personal compensation ratio

Use this simple check:

- Your compensation ratio = (Compensation credited) ÷ (Loss portion deemed incident-related)

- Loss portion deemed incident-related is not always your full liquidation loss; it’s the slice Binance attributes to abnormal mechanics (e.g., bad mark prints), not market direction.

- If you share (i) your liquidation loss, (ii) reference price vs. execution price, and (iii) the amount you received, we can compute the exact % you were compensated for.

6) Practical tips

- Document everything: timestamps, order IDs, screenshots of chart anomalies or index spikes.

- If you think the credit is too low, reply to the support ticket with your evidence and request a re-evaluation.

- Watch for expiry on vouchers/bonuses; some credits must be claimed or used within a set period.

Go to Binance Announcement > https://www.binance.com/en/support/announcement/detail/3d45a1ab541f463982d59c8de85e36b8

Editor's CommentJoin the Discussion Share your take with the community →

- Theme of the day: persistent sell pressure, but floor defense at 110K endures—for now.

- A quick sweep to ~$109.5K followed by a firm reclaim would fit a constructive, liquidity-clearing script.

- Binance compensation is incident-based, case-by-case, and usually reflects the price delta attributable to abnormal mechanics, often paid as vouchers or stablecoin distributions. Check your Wallet history and Reward Center, and consider a ticket if you believe the amount under-represents your case.