!!! Warning: This article does not constitute investment advice. Any trading losses are the responsibility of the investor. !!!

Introduction

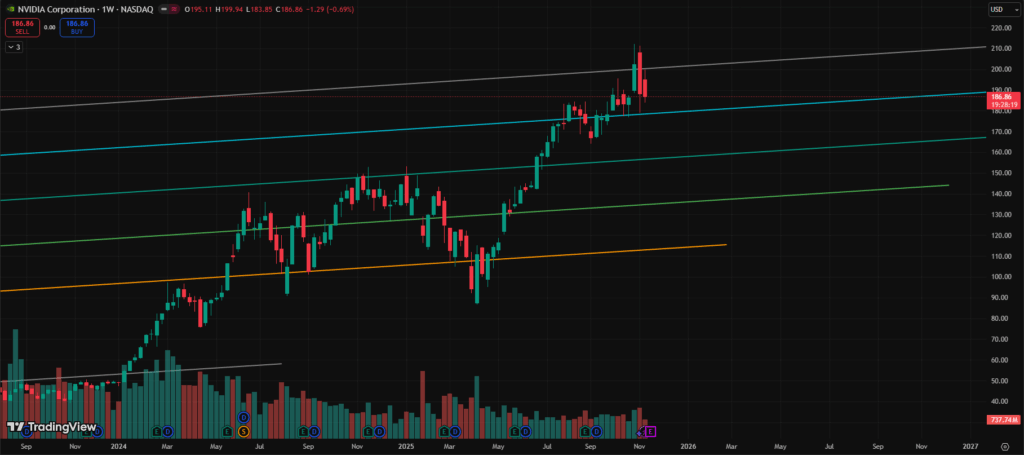

NVIDIA Corporation (NASDAQ: NVDA), the undisputed leader of the global AI chip market, has entered a volatile phase after hitting its recent peak of around $212. Once viewed as the core driver of the generative-AI boom, NVIDIA’s share price now reflects rising investor caution over an overheated tech sector. The turning point came as legendary investor Michael Burry—famed for his contrarian bet against the U.S. housing market during the 2008 crisis—disclosed large put-option positions targeting NVIDIA and other AI-heavy stocks. His move immediately reignited debate on whether the AI rally has crossed into bubble territory. Meanwhile, the Nasdaq Composite, which climbed past 26 000 earlier this quarter, has slipped toward the 25 000 channel, signalling growing fragility in the broader technology trade.

Main Body

1) Positive Perspective

Despite the turbulence, NVIDIA remains a structural pillar of the AI economy. Its GPU architecture dominates high-performance computing and large-scale model training, underpinning cloud services from Microsoft, Google, and Amazon. Demand for NVIDIA’s H100 and B200 accelerators continues to exceed supply, driving record-level data-centre revenue. Investors with a long-term horizon still view NVIDIA as a critical enabler of digital-infrastructure transformation, particularly in sectors such as robotics, autonomous driving, and AI supercomputing. Moreover, the company’s margin profile and technological lead give it resilience even amid short-term valuation adjustments. For these reasons, many institutions maintain an “overweight” stance, arguing that volatility represents an opportunity rather than a collapse.

2) Negative Perspective

Still, warning signs are accumulating. Analysts note that NVIDIA’s price-to-sales and price-to-earnings ratios remain far above historical averages, leaving little cushion for disappointment. The AI-infrastructure spending cycle—led by hyperscalers—appears to be flattening as firms reassess cost efficiency and hardware replacement timing. Michael Burry’s bearish position amplifies this concern, implying that institutional investors are preparing for a correction across the AI complex. In addition, macro headwinds such as higher U.S. Treasury yields and slowing corporate IT budgets have tempered enthusiasm. Technically, NVIDIA’s break below $190 introduces the risk of a deeper retracement toward its medium-term support zone near $175 if sentiment deteriorates further. The broader Nasdaq’s weakness reinforces that risk: momentum stocks are losing steam, and profit-taking is spreading across AI names.

Conclusion & Investment Implications

The debate around NVIDIA captures the broader tension in today’s AI-driven market—between long-term innovation and short-term valuation stress. Structurally, the company remains unmatched in technology leadership; cyclically, it faces fatigue after an extraordinary run-up. Investors should balance conviction with caution: maintain exposure to the AI theme, but implement defensive positioning through portfolio diversification or hedging. In the near term, watch for key catalysts such as next-quarter earnings, hyperscaler capex guidance, and U.S. interest-rate signals. Whether Michael Burry’s “Big Short 2.0” becomes prophetic or premature will hinge on how quickly AI demand converts into sustained profit rather than narrative momentum.