⚠️ Investment Notice

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Investments related to cryptocurrencies and associated equities involve significant volatility, and all investment decisions should be made at the sole discretion and responsibility of the investor.

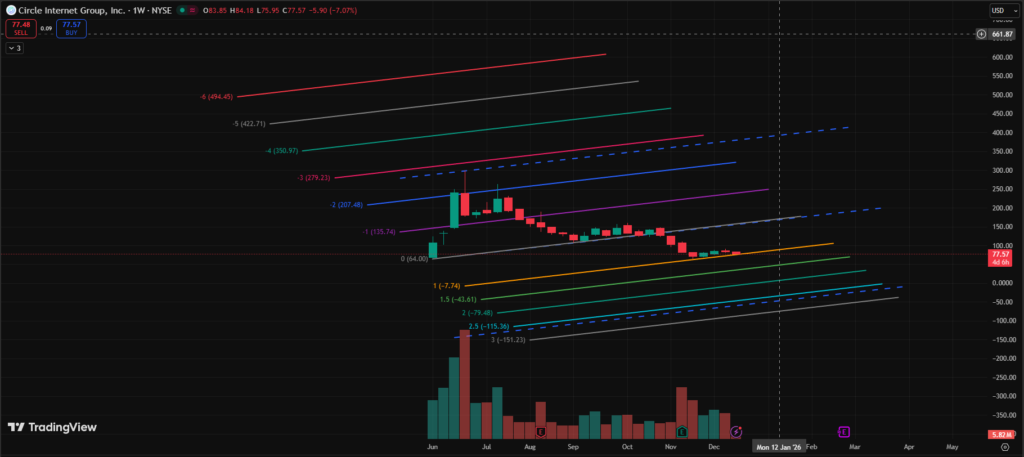

Circle (NYSE: CRCL), the U.S.-based issuer of the stablecoin USDC, has once again come under market scrutiny as its stock continues to trend lower. As the company behind one of the world’s most widely used stablecoins—second only to Tether’s USDT—Circle plays a central role in the digital asset ecosystem. Yet despite its strategic position, Circle’s share price has declined by more than 70% from post-IPO highs, raising persistent questions among investors: Is this a sign of deteriorating fundamentals, or simply the result of structural selling pressure?

(TradingView Circle Chart – Use Fib Channel)

Circle’s Revenue Model: At Its Core, a Bet on Interest Rates

Circle’s revenue structure is relatively straightforward. USDC is designed to maintain a one-to-one peg with the U.S. dollar, with reserves primarily held in U.S. Treasuries and cash-equivalent assets. The interest generated from these reserves—commonly referred to as reserve income—represents the company’s primary source of revenue and profit. As a result, Circle’s financial performance is closely tied to interest-rate conditions. Higher rates support stronger earnings, while expectations of rate cuts place downward pressure on future profitability. As uncertainty surrounding the Federal Reserve’s rate path grows, Circle has increasingly been treated by markets as a rate-sensitive financial stock, rather than a high-growth technology play.

Downside Pressure I: Structural Selling From Early Investors

One of the most significant contributors to Circle’s recent weakness appears to be structural selling pressure. Prior to its IPO, Circle raised capital from a broad base of venture capital firms and strategic investors. As post-IPO lockup periods expire, a portion of these early shareholders have gradually moved to realize gains and rebalance portfolios. This selling activity does not necessarily reflect a negative reassessment of Circle’s long-term prospects, but rather a natural consequence of liquidity becoming available. Notably, rallies in the stock have repeatedly been met with renewed selling, capping upside momentum.

Downside Pressure II: Event-Driven Trading and Institutional Caution

Circle has periodically benefited from regulatory headlines—such as progress toward U.S. oversight clarity or conditional approvals—but these events have tended to produce only short-lived price reactions. Once the initial excitement fades, the stock has struggled to sustain upward movement. Institutional investors largely view Circle not as a disruptive growth company, but as a regulated financial infrastructure provider, offering stability rather than explosive upside. This perception has limited long-term institutional accumulation and reinforced a pattern of selling into strength.

Downside Pressure III: A Divergence From Bitcoin’s Narrative

An additional layer of complexity lies in Circle’s diverging trajectory from Bitcoin. While Bitcoin has historically attracted aggressive accumulation during periods of extreme fear—often driven by long-term holders and large “whale” investors—Circle remains exposed to a different set of variables. Interest rates, regulatory developments, and equity-market risk sentiment all weigh heavily on Circle’s valuation, making it more vulnerable during broad risk-off environments.

Kim Peter View | “Is USDC Really at Risk? Focusing on Short-Term Decline Over Worst-Case Scenarios”

According to Kim Peter, current market conditions warrant perspective rather than panic.

“Bitcoin appears to be experiencing a level of extreme fear that historically has preceded strong accumulation by large holders,” he noted. “Time and again, Bitcoin has moved from deep fear into aggressive buying phases that eventually pushed prices beyond prior all-time highs. Circle, by contrast, is now trading more than 70% below its peak, has tested its IPO price, and after a brief rebound, has resumed its decline.”

He added that few market participants genuinely believe USDC—the de facto second settlement currency in crypto markets—is facing existential risk. “Rather than focusing on worst-case collapse scenarios, it may be more appropriate to view the current move as a structural and short-term adjustment. If investors were to accumulate gradually near key support levels, the long-term outcome could look very different. Many crypto investors likely established positions at significantly higher levels already, and while the current environment may feel uncomfortable, it is worth questioning whether panic-driven selling at this stage is truly justified.”

— Peter Kim, Korea-based journalist

Join the Discussion Share your take with the community →

First check $76.5

oh. it’s true.