[K-Reporter Kim] Korea’s Economy Faces a Turning Point? — Rising Sentiment Amid Market Volatility

![[K-Reporter Kim] Korea’s Economy Faces a Turning Point — Rising Sentiment Amid Market Volatility](https://knewsdaily.com/wp-content/uploads/2025/11/K-Reporter-Kim-Koreas-Economy-Faces-a-Turning-Point-—-Rising-Sentiment-Amid-Market-Volatility.png)

Introduction

South Korea’s economy entered the final stretch of 2025 under contrasting signals — improving consumer confidence but rising market volatility. The KOSPI index, after briefly approaching 4,200 points earlier this month, has now retreated to around 3,850, reflecting investor caution amid concerns over global technology demand and geopolitical uncertainty. Meanwhile, the Korean won has weakened slightly to ₩1,461 per U.S. dollar, reversing its earlier gains as traders recalibrate expectations regarding the widening interest-rate gap between the Federal Reserve and the Bank of Korea. These market shifts come even as Korea’s domestic indicators show resilience: consumer sentiment and household spending remain firm, suggesting that the local economy may still be on a path toward gradual recovery despite external headwinds.

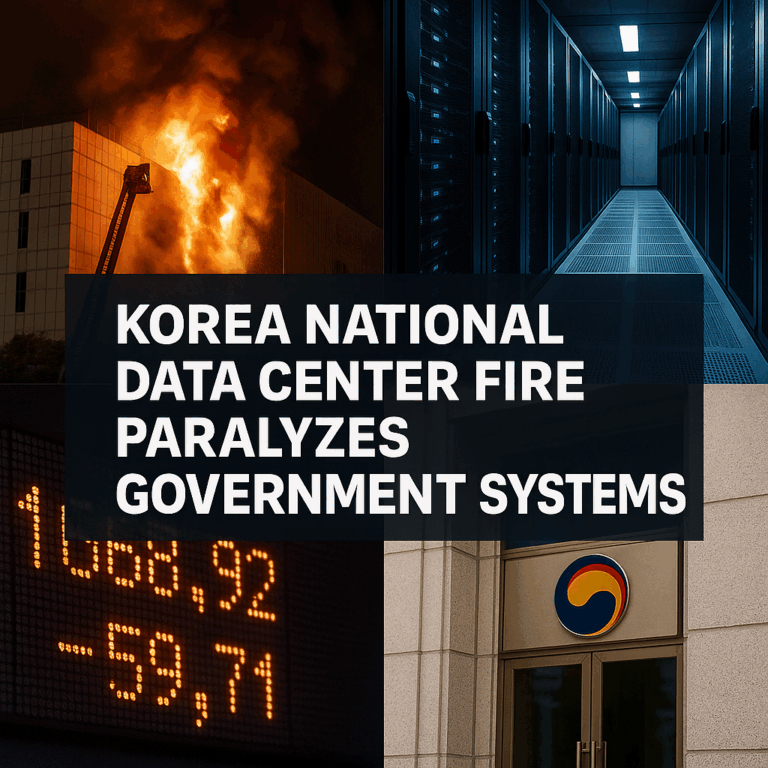

Image1. (Korean statistical information service – Current status of CSI in Korea)

Domestic Strengths and Resilience

Recent macroeconomic indicators reveal a cautiously optimistic tone. The Composite Consumer Sentiment Index (CCSI) climbed to 112.4 in November, the highest since 2017, as households expressed greater confidence in income stability, employment prospects, and the national economy’s direction. This rebound in sentiment reflects the resilience of Korea’s service sector, a steady job market, and moderate inflation levels. Moreover, the government’s planned fiscal measures — including targeted tax incentives for SMEs, green-tech start-ups, and digital-export companies — are expected to support domestic demand. Although investment in construction and manufacturing has slowed, private consumption remains the main engine of growth, supported by rising wages and inflation stabilizing near the 2 % target. Retail sales and domestic tourism also continue to show steady improvement, further boosting confidence among small businesses and service providers.

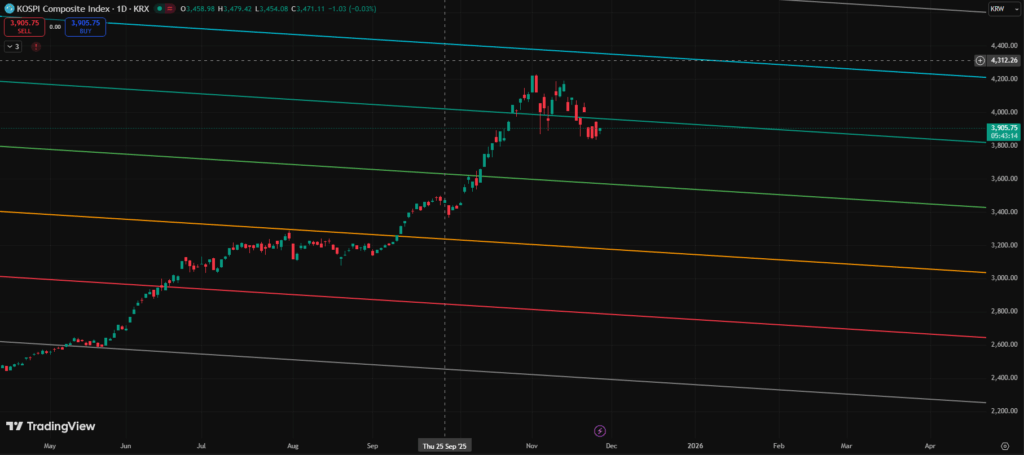

Image2. KOSPI Chart(Trading view)

Financial Markets and Currency Pressure

The recent retreat in the KOSPI highlights growing investor caution toward high-valuation sectors, particularly semiconductors and AI-linked equities, which had driven much of the earlier rally. While foreign funds were net buyers through most of the third quarter, the past two weeks have seen modest outflows as global investors adopt a risk-off stance. Institutional investors are rotating toward defensive sectors — energy, utilities, and consumer staples — reflecting a shift toward portfolio protection amid uncertainty.

On the currency side, the Korean won’s depreciation toward ₩1,461 per dollar underscores renewed strength in the U.S. dollar as markets anticipate a slower-than-expected pace of Federal Reserve rate cuts in 2026. A weaker won provides temporary support to exporters by improving price competitiveness, but it also raises import costs for energy and raw materials, pressuring corporate margins and household purchasing power.

Financial analysts emphasize that maintaining currency stability near the ₩1,450–₩1,470 range will be essential for sustaining investor confidence and policy credibility as Korea heads into the first half of 2026.

Structural Challenges and External Risks

Despite signs of resilience, Korea continues to face structural challenges that limit growth momentum. Export performance remains uneven — while semiconductor shipments show tentative recovery, overall global demand for consumer electronics and capital goods remains subdued. Construction investment and fixed-capital formation have weakened due to higher borrowing costs, tightening financial conditions, and lingering property-market risks. Meanwhile, household debt, now exceeding 100 % of GDP, continues to restrain spending capacity and amplify financial vulnerabilities. Demographic pressures — an aging population and persistently low birth rates — pose long-term challenges to labor supply, productivity, and fiscal sustainability.

Externally, the slowdown in China’s manufacturing rebound, fluctuating energy prices, and geopolitical instability in the Middle East all represent risks to Korea’s trade-dependent economy. Global investors also remain cautious amid domestic policy uncertainty, particularly regarding regulatory reforms and fiscal management ahead of key legislative sessions in Seoul.

Outlook and Policy Direction

The Bank of Korea (BOK) is expected to maintain its base rate at 3.25 % through the first half of 2026, focusing on price stability and currency management. Fiscal authorities are prioritizing targeted stimulus rather than broad expansion, emphasizing competitiveness in green tech, semiconductors, and AI-related industries.

Analysts at the Korea Development Institute (KDI) forecast GDP growth around 1.8 % in 2026, with domestic consumption offsetting external softness. To sustain recovery momentum, policy focus must remain on three pillars:

1) Reinforcing domestic demand via household income support and labor-market reform.

2) Enhancing export competitiveness through market diversification and tech innovation.

3) Managing financial risk by curbing household leverage and stabilizing the housing market.

Conclusion

Korea’s economy stands at a decisive crossroads where resilient domestic fundamentals meet volatile global conditions. The simultaneous drop in the KOSPI and weakening of the won underline lingering market unease, yet the rebound in consumer confidence suggests that the Korean public remains hopeful about the nation’s future trajectory. If domestic demand holds steady and fiscal-monetary coordination strengthens, Korea could navigate this transition phase without major disruption — positioning itself for renewed growth by mid-2026. However, if investor confidence fails to recover and exports remain stagnant, the gap between economic optimism and market reality could widen further.

Ultimately, the coming months will determine whether Korea’s economy can transform current volatility into sustainable momentum — or whether it will remain trapped between short-term market pressures and long-term structural constraints.

In Korea, where opinions are always split 50/50, reactions to the current exchange rate and KOSPI index are also split.

While it would be best to participate in the market with the belief that government policies will lead to positive outcomes, investors cannot view the current situation solely optimistically.

As feared, investors who borrowed money at the current peak are already suffering significant losses, and I believe those losses could further increase.

[Peter Kim | Korea-based journalist covering stories from within Korea]