[Korea Daily Snapshot] November 27 Morning Edition

** Rising Market Volatility, Policy Uncertainty, and Currency Pressure Define the Day **

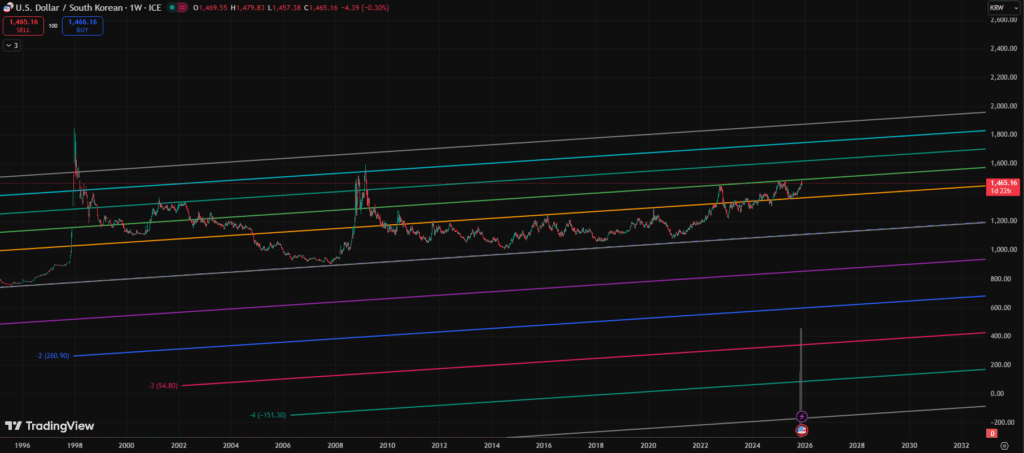

Image1. U.S. dollar / South Korean chart (Trading View)

Won Weakens Past ₩1,470 — Government Signals Readiness for FX Stabilization

The Korean won briefly crossed the ₩1,470 per U.S. dollar threshold on Tuesday, marking its weakest level in months. The government swiftly convened an emergency meeting with the Ministry of Economy and Finance, Bank of Korea, and National Pension Service to discuss stabilization measures.

Officials stated that the authorities would “take preemptive steps against speculative currency movements,” but no immediate market intervention has been confirmed.

Analysts noted that the recent depreciation reflects a mix of stronger U.S. dollar sentiment and foreign-capital outflows amid shifting interest-rate expectations between Seoul and Washington.

Image2. KOSPI chart (Trading View)

KOSPI Under Pressure as Foreign Funds Sell, Retail Investors Rush In

Foreign investors have offloaded more than ₩14 trillion ($10 billion) in Korean equities this month — the largest monthly outflow on record — as rising U.S. yields and currency risks spooked offshore funds.

Conversely, retail investors have been buying aggressively, driving margin-loan balances to historic highs and raising concerns of excessive leverage.

The KOSPI, which touched 4,200 points earlier in November, is now fluctuating near 3,850, signaling a tense tug-of-war between foreign “sell Korea” sentiment and domestic “buy-the-dip” optimism.

U.S.–Korea Tariff Deal Bill Set for Submission — Boost for Export Sectors

Korea’s ruling party is preparing to submit a bill implementing the recently negotiated tariff-reduction agreement with the United States, which lowers specific import duties from 25 % to 15 %.

Once enacted, the legislation would encourage Korean corporate investment in U.S. manufacturing and enhance bilateral trade flows, particularly in automotive, electronics, and consumer-goods exports.

Analysts expect this move to ease supply-chain bottlenecks and improve Korea’s export competitiveness through 2026.

Political Risk Rises — Former PM Han Duck-soo Faces 15-Year Sentence Request

A special prosecutor has sought a 15-year prison sentence for former Prime Minister Han Duck-soo, accused of involvement in a 2024 “martial-law attempt.”

The indictment has shaken investor confidence, raising concerns about political stability and judicial credibility ahead of next year’s parliamentary session.

Analysts warn that the verdict could have ripple effects on policy continuity and foreign investment sentiment.

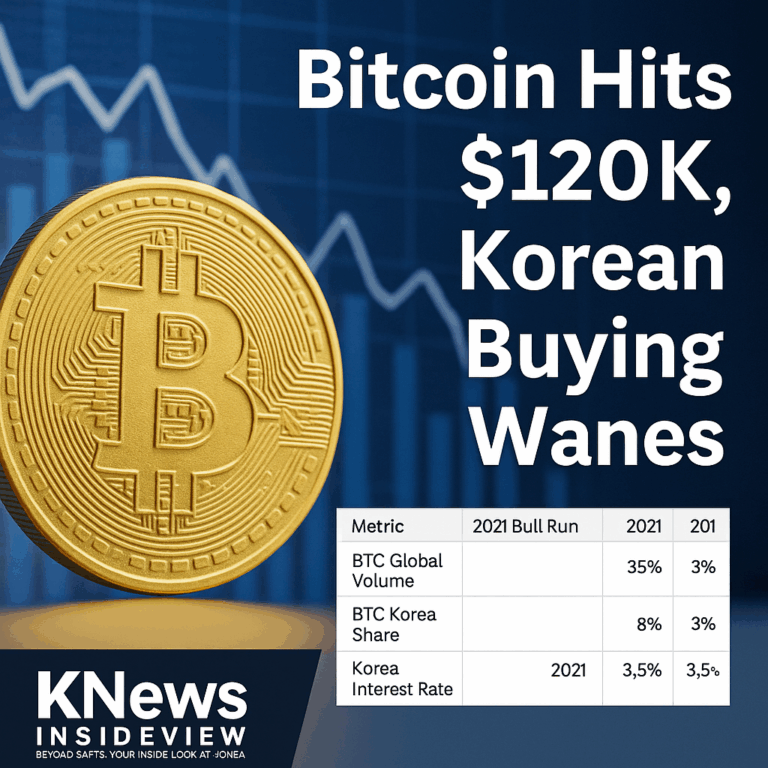

Monetary Policy — BOK Expected to Hold Rates Amid FX Volatility

The Bank of Korea is expected to maintain its base rate at 2.50 % during today’s policy meeting, as authorities weigh the trade-off between stabilizing the won and supporting domestic growth.

With inflation hovering near 2 % and the currency under pressure, policymakers are prioritizing financial-market stability over short-term stimulus.

Any potential rate cut is now likely postponed to Q2 2026, according to consensus forecasts.

Overall Assessment & Market Takeaway

- Triple Headwind — FX Weakness, Foreign Outflows, and Policy Caution

These combined forces could weigh on both corporate margins and consumer purchasing power if the won remains above ₩1,460. - Medium-Term Positives — Tariff Deal and Government Coordination

The trade bill with the U.S. and official pledges for FX stabilization provide some reassurance for exporters and long-term investors. - Political Risk — Han Trial Raises Uncertainty

Heightened political tension could delay policy decisions, impacting business confidence. - Monetary Dilemma — Balancing Stability vs. Growth

The BOK’s stance reflects a delicate effort to anchor the won while avoiding further strain on household debt and consumption.

[Peter Kim | Korea-based journalist covering stories from within Korea]

ok