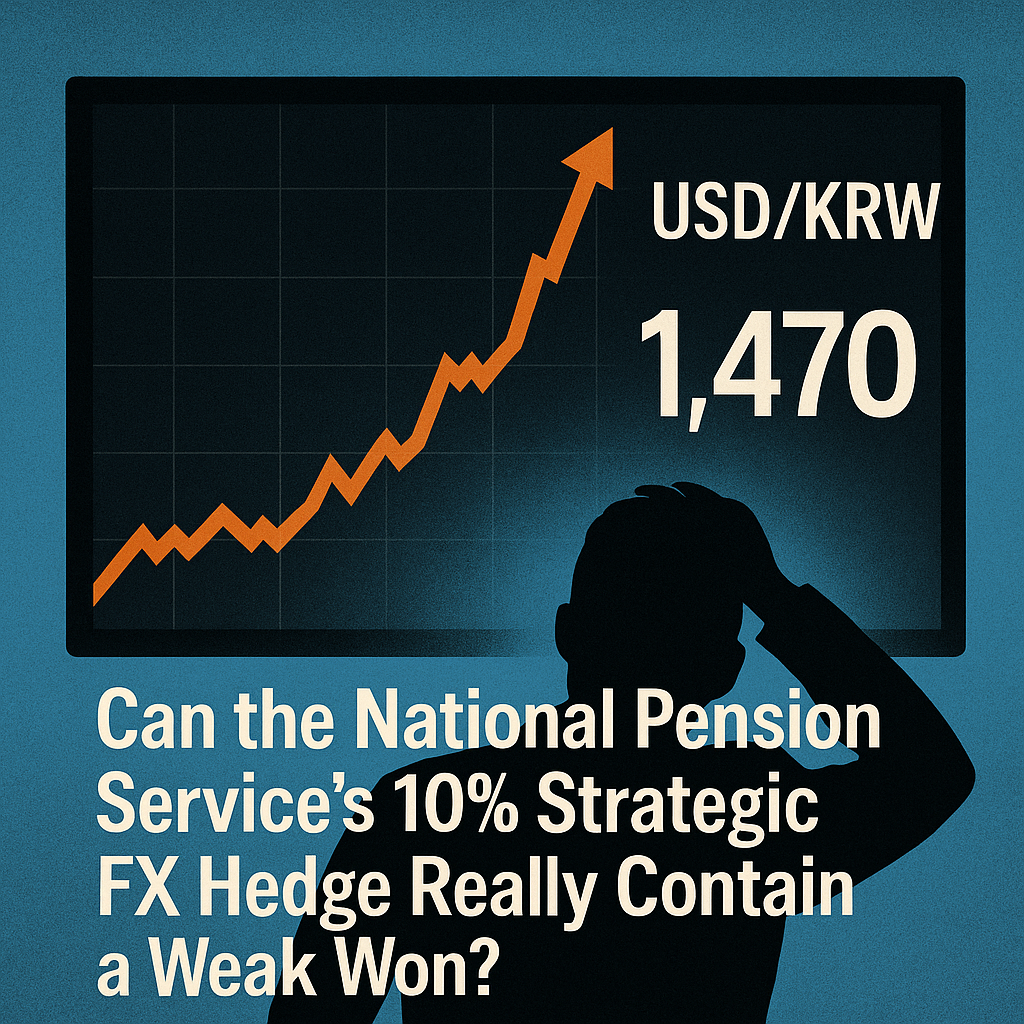

[Korea Economy] Can the National Pension Service’s 10% Strategic FX Hedge Really Contain a Weak Won?

[Korea Economy] South Korea’s National Pension Service (NPS) has entered renewed discussions on expanding its strategic foreign-exchange hedging as the won continues to trade at elevated levels against the U.S. dollar. Introduced in 2022, the strategic hedge framework allows the NPS to hedge 5–10% of its overseas assets when the exchange rate deviates significantly from what authorities consider a normal range. As the won-dollar rate recently fluctuated around the mid-1,400s, attention has turned to whether this mechanism can meaningfully stabilize the currency—or whether its impact is inherently limited.

The Case for Hedging: Short-Term Stabilization and Risk Management

Supporters of the strategy argue that the NPS’s hedging activity can act as a temporary stabilizer during periods of excessive volatility. By selling dollars through forward contracts at pre-agreed exchange rates, the pension fund can supply foreign currency to the market when dollar demand becomes overheated. While not designed as a permanent intervention tool, this mechanism is seen as capable of easing panic-driven moves and dampening sharp, disorderly swings in the exchange rate.

From a portfolio perspective, advocates also emphasize the potential benefits for long-term returns. Locking in favorable exchange rates during periods of extreme weakness in the won could help protect the value of overseas investments and even generate foreign-exchange gains if the currency later recovers. With some analysts expecting medium-term appreciation in the won—supported by factors such as global bond index inclusion and improved external balances—the NPS’s strategic hedging is viewed by proponents as a prudent risk-management tool, rather than an attempt to directly control the market.

The Skeptical View: Limited Scale in a Global Market

Critics, however, question whether a 10% hedging ratio can meaningfully influence the broader foreign-exchange market. Even though the NPS manages one of the world’s largest pension portfolios, the scale of global FX trading dwarfs the potential impact of a single institutional player. As a result, skeptics argue that while hedging may smooth short-term volatility, it is unlikely to alter the underlying direction of the exchange rate, which is primarily driven by U.S. interest rates, global risk sentiment, and cross-border capital flows.

Concerns have also been raised about the independence of the pension fund. The strategic hedge was originally designed to protect long-term investment performance, not to serve as a de facto policy tool for currency stabilization. If the NPS were perceived as acting under policy pressure, critics warn, it could undermine confidence in the fund’s governance and expose it to political controversy. Moreover, should the weak-won environment persist longer than expected, hedging costs and opportunity losses could ultimately weigh on overall returns.

A Shield, Not a Silver Bullet

Taken together, most market observers arrive at a nuanced conclusion: the NPS’s 10% strategic FX hedge is not a silver bullet capable of reversing the won’s trajectory, but rather a defensive shield designed to soften shocks during periods of abnormal volatility. It may help calm market psychology and reduce short-term fluctuations, but it cannot override the structural forces shaping currency movements.

In that sense, the debate is less about whether the strategy “works” and more about how it should be positioned and communicated. As long as the hedge remains clearly framed as a risk-management measure—implemented transparently and without compromising the fund’s long-term independence—it can play a constructive, albeit limited, role in navigating a prolonged era of currency uncertainty.

— Peter Kim, Korea-based journalist [Korea Economy]

Join the Discussion Share your take with the community →